Chengdu Adjusts Housing Provident Fund Loan Repayment Policy to Stabilize Market

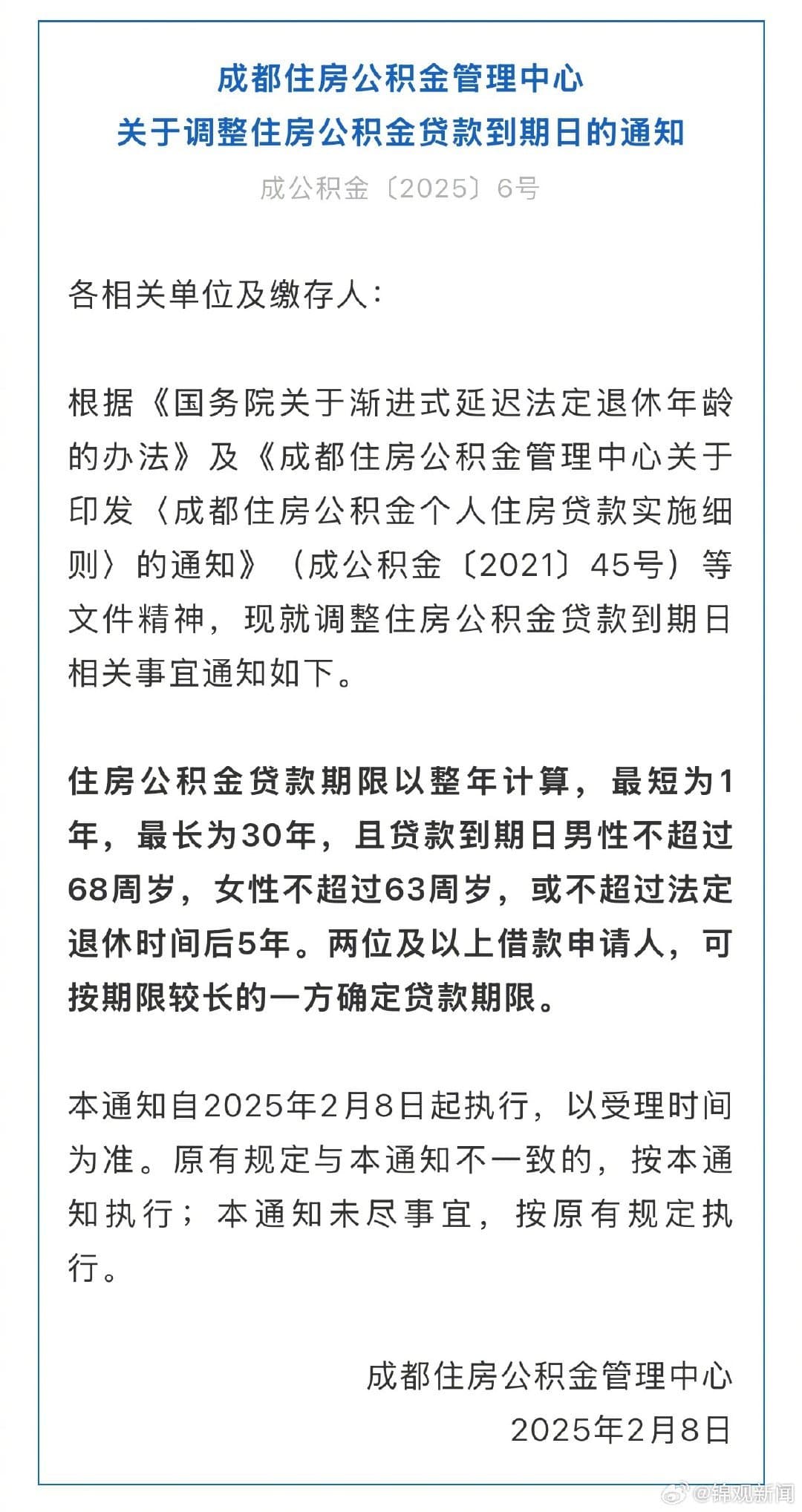

On February 8, the Chengdu Housing Provident Fund Management Center issued a notice announcing adjustments to the repayment period for housing provident fund loans. The new policy states that the loan repayment period for males shall not exceed 68 years of age, and for females, it shall not exceed 63 years of age. Alternatively, the repayment period shall not exceed 5 years after the statutory retirement age. This move aims to extend the loan repayment period and ensure that it does not exceed 5 years after the borrower's retirement age, aligning with the country's gradual delay in the statutory retirement age.

8 February 2025

The loan term shall be calculated in whole years, ranging from a minimum of 1 year to a maximum of 30 years. For joint loan applicants, the loan term shall be determined based on the longer term of the two parties. The new policy took effect on February 8, 2025, and applies to all related units and depositors, superseding any existing regulations that contradict this notice. The adjustment is expected to have a positive impact on the housing market in Chengdu, providing more flexibility and convenience for borrowers and supporting the city's housing development.

The recent adjustment to the housing provident fund loan policy in Chengdu has sparked concerns about the potential impact on the housing market and the economy as a whole. With the current economic downturn and downward pressure on the domestic economy, the housing market is in need of stability. A significant decline in housing prices would put immense economic pressure on many families, potentially leading to insolvency. The housing market has a ripple effect on numerous industries, including construction, building materials, and home furnishings, making it a crucial sector that requires careful management.

The adjustment to the housing provident fund loan policy is intended to stabilize the housing market and prevent a sharp decline in prices. The new policy adjusts the loan repayment period, allowing borrowers to repay their loans over a longer period, thereby reducing their monthly burden. This move is expected to alleviate some of the pressure on households and help maintain stability in the housing market. However, some experts argue that the policy adjustment may not be enough to address the underlying issues in the housing market, as the root cause of the problem lies in excessive speculation and investment, which has driven up prices and made it difficult for ordinary people to afford housing.

Various cities are successively introducing policies to stabilize the housing market, including relaxing purchase restrictions and lowering down payment ratios. These policies aim to promote the healthy development of the real estate market and inject vitality into it. The recent adjustments to the housing provident fund loan policy in Chengdu are part of the efforts to regulate the market and demonstrate the government's commitment to maintaining stability in the real estate market. By introducing such policies, the government aims to create a favorable environment for the healthy development of the housing market, ensuring that it continues to play a vital role in supporting the country's economic growth and providing a stable and secure living environment for its citizens.

We look forward to these policies taking effect, allowing the housing market to recover as soon as possible, and enabling the "dream of having a home" for the general public to become a reality sooner. Maintaining the stability of the housing market is actually equivalent to safeguarding the happiness of countless families. The government's efforts to support the housing market and alleviate the financial burdens on homebuyers are crucial to preventing a broader economic downturn. By implementing these policies, the government aims to create a healthier and more sustainable housing market, which in turn will have a positive impact on related industries. Ultimately, the goal is to ensure that the "dream of having a home" becomes a reality for more people, and that the happiness of countless families is protected.

Comments