China Mulls Stimulus Package to Stabilize Stock Market

Stock Market Stimulus: China Mulls Bundle of Measures to Stabilize Shares

23 January 2024

China is reportedly considering a bundle of measures to stabilize its stock market, according to a report by Bloomberg. The news spread like wildfire on Chinese social media, with netizens expressing hope and frustration about the situation.

On January 23rd, the A-shares market suffered a sudden slump, but shortly after, it staged a recovery, with major indexes quickly turning green. The Hang Seng Index in Hong Kong also surged by more than 3%, while the Hang Seng Tech Index rose by over 5%. The market was reportedly boosted by the potential stimulus measures being mulled by the Chinese government.

However, some netizens were skeptical about these measures, with one user writing, "快来吧,多头快顶不住了" ("Come quickly, the bulls can't hold up"), expressing concerns about the stability of the market. Another user urged other investors to "树立正确投资观,格局放大点,不要单纯以盈利为目的" ("Establish a correct investment outlook. Have a bigger picture. Don't just aim for profits").

Some Weibo users have expressed frustration with the pace of the government's response, with one user writing, "抓紧考虑 争取在散户还在的时候出来" ("Hurry up and consider it. Try to come out while the retail investors are still there"). Another user wrote, "还需要外媒给消息来刺激股市" ("We still need foreign media to give news to stimulate the stock market"), frustration that a foreign outlet was the first to report the news.

Despite the mixed reactions from netizens, some remained optimistic about the potential impact of the stimulus measures. One user wrote, "工具箱打开后,工具多种多样,我相信接下来的一揽子措施一定可以稳住资本市场,我们一定会赢!" ("After the toolbox is opened, there are many tools. I believe that the subsequent package of measures will be able to stabilize the capital market, and we will definitely win!")

However, others were skeptical about the efficacy of the stimulus measures. One user expressed their frustration, writing, "A股大盘不乐观,有人炒股亏了钱,有人一亏再亏" ("The A-shares market is not looking good. Some people are losing money in the stock market, and some people are losing money over and over again"). Another user suggested that the government should focus on addressing structural issues in the market, writing, "权威经济学家充满鄙视与不屑:'那是因为股市连规范的赌场都不如,市场经济出了问题,只能用更加市场的办法来解决'" ("Authoritative economists are filled with contempt and disdain, 'That's because the stock market is not even as regulated as a casino. When the market economy encounters problems, it can only be solved with more market-oriented methods'").

The news has also sparked discussions about the role of foreign media in reporting on China's stock market, with one user writing, "网传停止IPO,他们出来辟谣!网传禁止做空,他们出来辟谣!每次传出振奋市场的利好消息,他们都会出来辟谣!到底是哪一边的?希望这次是真的!" ("There are rumors that the IPO will be stopped, and they came out to debunk it! There are rumors that short selling is banned, and they came out to debunk it! Every time there is news of good news for the market, they come out to debunk it! Which side are they on? I hope this time is true!").

As of today, A-shares have suffered a market value loss of 7 trillion yuan since the beginning of the year. Some investors are calling for more tangible measures to address the market's woes.

Despite the mixed reactions, the Chinese government is yet to confirm the reported stimulus measures, raising concerns about the reliability of the news and potential market manipulation. Netizens are calling for a thorough investigation into the source of the news, with one user writing, "知情人士是谁,既然未获授权,彭博社如何得知。是不是应该好好查查这样的知情人士。中国股市搞不好,不正是因为这样的害群之马吗?如果是假,更应该好好查查源头,谁在发布假消息从中渔利。" ("Who is the person in the know? Since there is no authorization, how does Bloomberg know? Shouldn't we investigate such insiders thoroughly? Is it precisely because of such mischievous animals that the Chinese stock market cannot improve? If it's fake, we should investigate the source more, who is releasing false news to benefit from it.")

In conclusion, while the Chinese government is reportedly considering a bundle of measures to stabilize its stock market, reactions from netizens have been mixed, with some expressing hope and others frustration. The news has also sparked discussions about the role of foreign media in reporting on China's stock market and the need for greater transparency and accountability in the market.

Share this article

Related Articles

Xi Jinping Elevates Cybersecurity to Core National‑Security Pillar, Driving China’s Quest for a Cyber Superpower

By Trending on Weibo

News & Politics

15 Sept 2025

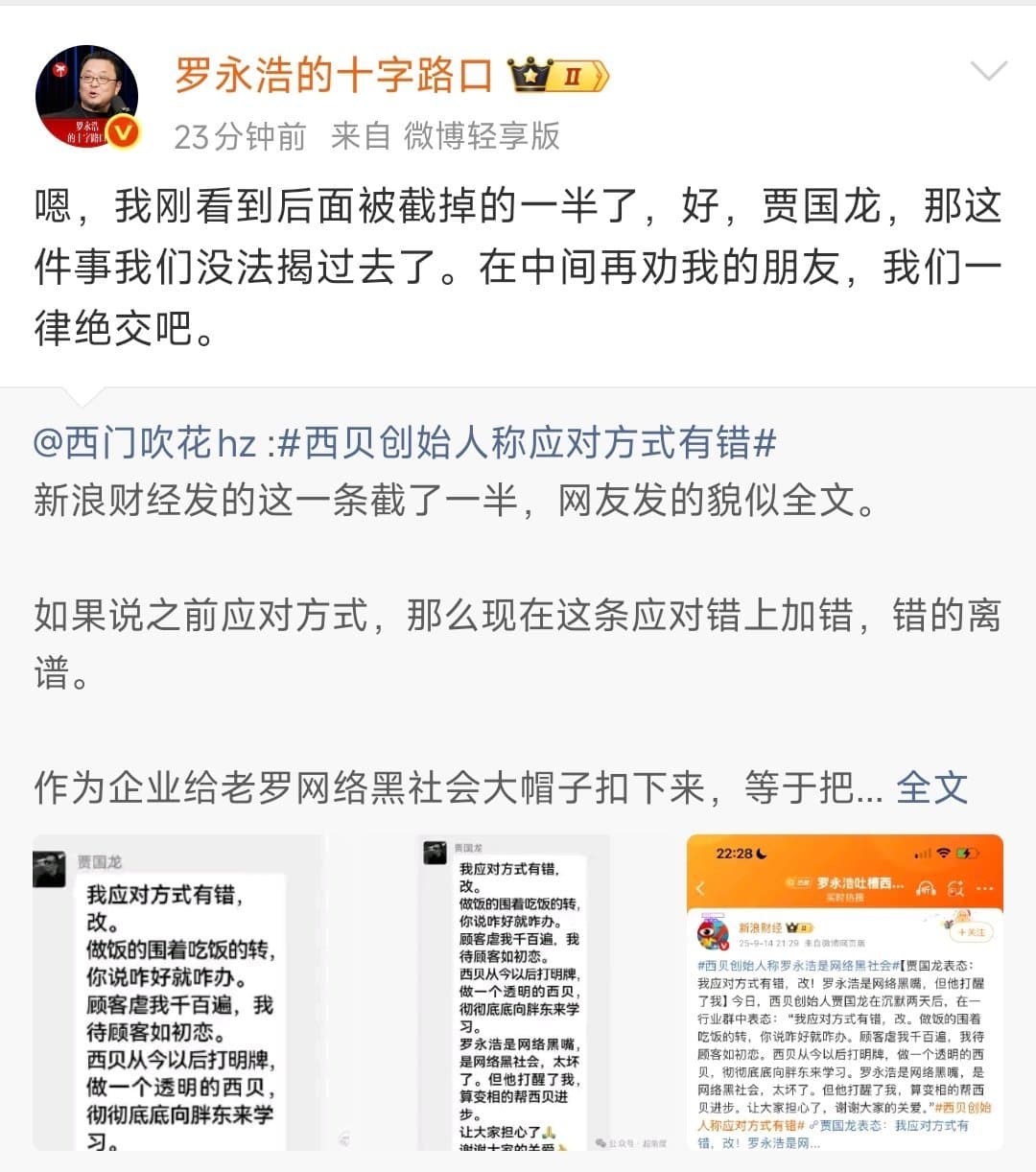

Luo Yonghao vs. Xibei: Celebrity Entrepreneur Sparks Media Storm Over Pre‑Made Dishes and Calls for Transparency

By Trending on Weibo

News & Politics

15 Sept 2025

Weibo Celebrates Autumn Harvest as China’s Fields Become the Nation’s Most Beautiful Canvas

By Trending on Weibo

News & Politics

15 Sept 2025

China Enacts First Comprehensive Rental Regulations to Legalize and Stabilize the Rental Market

By Trending on Weibo

News & Politics

15 Sept 2025

Beijing’s Weather Emerges as a Barometer for China’s Climate Policies and Public Life

By Trending on Weibo

News & Politics

13 Sept 2025