Chinese Semiconductor ETF Surges 70% in 15 Days: What's Driving the Rally?

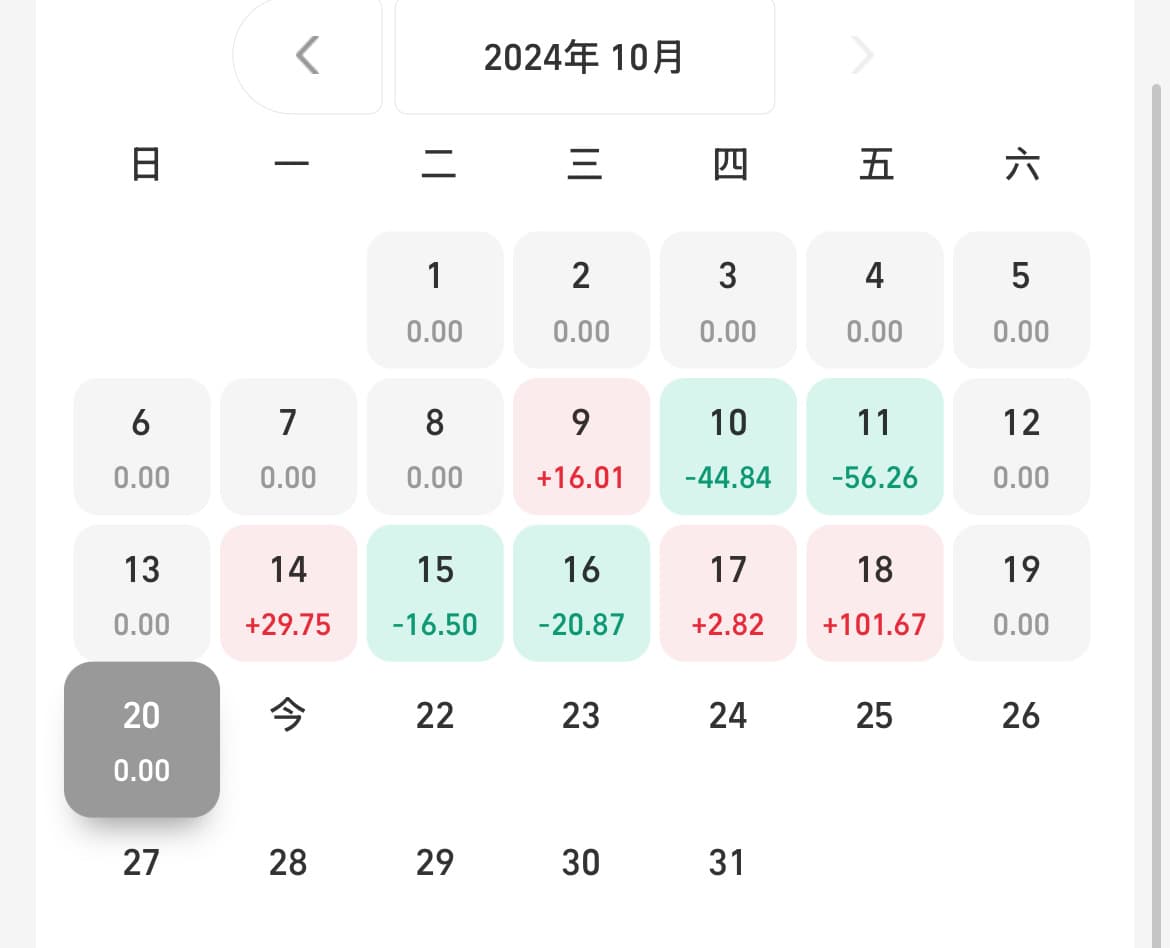

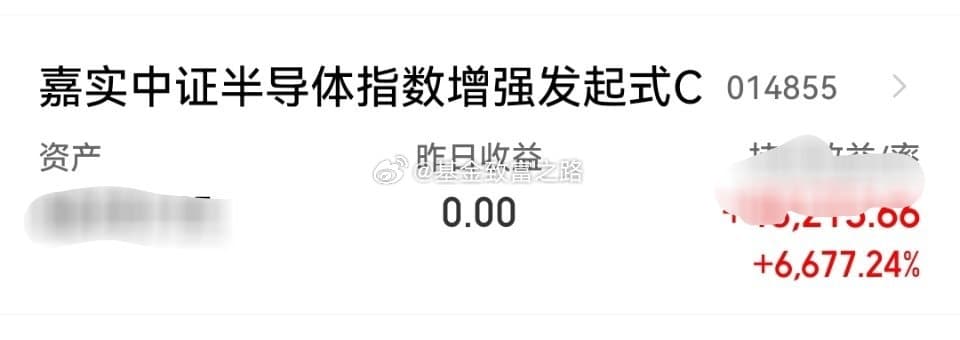

The recent 70% surge in the North Exchange (北交所) semiconductor ETF over 15 days has sparked widespread interest and speculation among investors. But what are the underlying factors driving this remarkable rally?

21 October 2024

Industry insiders and analysts point to a combination of factors contributing to this surge. Firstly, the semiconductor sector has been benefiting from the global trend of increasing demand for chips and other semiconductor products, driven by the ongoing digitization of industries and the proliferation of emerging technologies such as artificial intelligence, the Internet of Things (IoT), and 5G.

Secondly, the Chinese government has been actively promoting the development of the domestic semiconductor industry through supportive policies and investments, which has boosted investor confidence in the sector. The government's "Made in China 2025" initiative, which aims to upgrade the country's manufacturing capabilities, has also highlighted the importance of semiconductors as a key strategic industry.

Thirdly, the recent IPOs and listing of several high-profile Chinese semiconductor companies on the mainland exchanges, including the North Exchange, have brought attention and capital to the sector, driving up valuations and investor interest.

Lastly, the recent performance of related sectors such as technology and finance has also had a spillover effect on the semiconductor sector, with investors seeking to diversify their portfolios and capitalize on the growth momentum.

While some investors have questioned why their fund investments have not seen similar gains, industry experts point out that the rally in the semiconductor ETF has been driven largely by short-term market sentiment and momentum trading, rather than fundamental changes in the underlying companies' valuations or performance.

Looking ahead, analysts point to several key factors that will shape the sector's long-term development. The growing adoption of emerging technologies such as artificial intelligence, 5G, and the Internet of Things (IoT) is expected to drive demand for advanced semiconductor products. China's push for technological self-sufficiency is also likely to lead to increased investment in research and development, as well as the establishment of new manufacturing facilities.

The semiconductor industry is highly competitive, and consolidation and mergers and acquisitions are likely to become more prevalent. This trend is expected to lead to the emergence of stronger, more competitive companies, better equipped to invest in research and development and respond to changing market demands.

Investors are advised to approach the semiconductor sector with a long-term perspective, focusing on companies with strong research and development capabilities, solid financials, and a proven track record of innovation. While the recent surge in semiconductor stocks has been impressive, market fluctuations are inevitable, and investors should be prepared for potential volatility.

For those looking to ride the wave, exchange-traded funds (ETFs) offer a convenient and diversified way to tap into the sector's growth potential. Before investing in semiconductor ETFs, consider the underlying index, expense ratio, trading volume, and leverage and risk management.

Some popular semiconductor ETFs in China include the Huaxia CSI Semiconductor ETF, Invesco CSI Semiconductor ETF, and E Fund CSI Semiconductor ETF. To make the most of the current semiconductor boom, consider strategies such as dollar-cost averaging, trend following, and sector rotation.

Analysts are divided on the short-term prospects for the semiconductor ETF, but most agree that the sector's long-term growth prospects remain robust. As one analyst put it, "The semiconductor sector is a high-growth, high-volatility space. Investors who are willing to take calculated risks and ride out the ups and downs can potentially reap significant rewards."