No End in Sight for Gold Price Surge

The recent surge in international gold prices can be attributed to several factors, including concerns among investors that the Trump administration may impose high tariffs on gold and other precious metals, prompting them to take action beforehand. This fear has led to a large inflow of physical gold from London to New York, further driving up prices. Additionally, ongoing geopolitical risks, such as the conflict between Russia and Ukraine, as well as the US-Iran tensions, have contributed to the upward trend in gold prices. The uncertainty surrounding these events has led investors to seek safe-haven assets, such as gold, driving up demand and prices.

11 February 2025

The expectation of a possible interest rate cut by the US Federal Reserve has also played a role in the gold price surge. Lower interest rates can lead to a decrease in the opportunity cost of holding gold, making it more attractive to investors. Furthermore, the current inflationary environment in the US has also contributed to the gold price increase. As inflation rises, investors often turn to gold as a hedge against inflation, driving up prices. According to analysts, the combination of these factors has created a perfect storm that has driven up gold prices to historic highs, with some predicting that the uptrend may continue in the short term.

As the international gold price continues to soar, its impact on consumer behavior is becoming increasingly evident. With the price of gold per gram exceeding 886 yuan, many consumers are reconsidering their purchasing decisions. Some have expressed concerns that the current price is too high, and they are hesitant to buy, opting to wait for a potential drop in price. However, experts warn that the gold price may continue to rise, driven by factors such as global economic uncertainty, geopolitical risks, and the weakening of the US dollar. The rising gold price has already started to affect the sales of gold jewelry, with some consumers reporting that they are no longer interested in buying gold jewelry due to the high price, while others are opting for alternative materials such as silver or platinum.

Investors are also growing increasingly cautious as the gold price continues to rise. According to strategists, there is currently no clear indication that the gold price will stop rising, and the question remains whether the pace of the increase will slow down. Some investors are expressing frustration and hesitation about investing in gold at its current high price, torn between fear of buying at a high position and fear of missing out if they don't invest. As a result, many are taking a wait-and-see approach, waiting to observe how the gold price will move in the coming days.

The relentless surge in gold prices is also sending shockwaves through the gold jewelry industry, a sector that has long been a significant consumer of the precious metal. With gold prices continuing to climb, manufacturers and retailers of gold jewelry are facing unprecedented pressure to adapt to the new market realities. Many are being forced to reassess their pricing strategies, with some opting to absorb the increased costs and others exploring alternative materials or adjusting their product designs to use less gold. The trickle-down effect of higher gold prices is also being felt by consumers, who are witnessing a significant increase in the cost of gold jewelry, potentially leading to a decline in demand and a shift in consumer behavior.

The surge in gold prices is also altering the dynamics of the global gold jewelry market, with countries with a strong tradition of gold jewelry production potentially seeing their exports decline as higher prices make their products less competitive in international markets. Conversely, countries with a stronger focus on affordable, trendy jewelry may capitalize on the shift in consumer preferences, gaining market share as buyers seek out more budget-friendly alternatives. As the industry navigates this challenging landscape, it remains to be seen how the various stakeholders will respond and what the long-term implications will be for this traditional and culturally significant sector. Overall, the rising gold price is having a significant impact on consumer behavior, investors, and the gold jewelry industry, with many opting to wait or seek alternative materials due to the high cost, and experts warning that the market may be due for a correction.

Comments

Share this article

Related Articles

Falcons Edge XG 3‑2 in TI14 Finals, Leaving Chinese Star Ame a Three‑Time Runner‑Up

By Trending on Weibo

Sports

15 Sept 2025

Xi Jinping Elevates Cybersecurity to Core National‑Security Pillar, Driving China’s Quest for a Cyber Superpower

By Trending on Weibo

News & Politics

15 Sept 2025

Ruby Lin Says She and Wallace Huo Are Still “Adjusting” After Seven Years, Igniting Viral Debate on Celebrity Marriages

By Trending on Weibo

Entertainment

15 Sept 2025

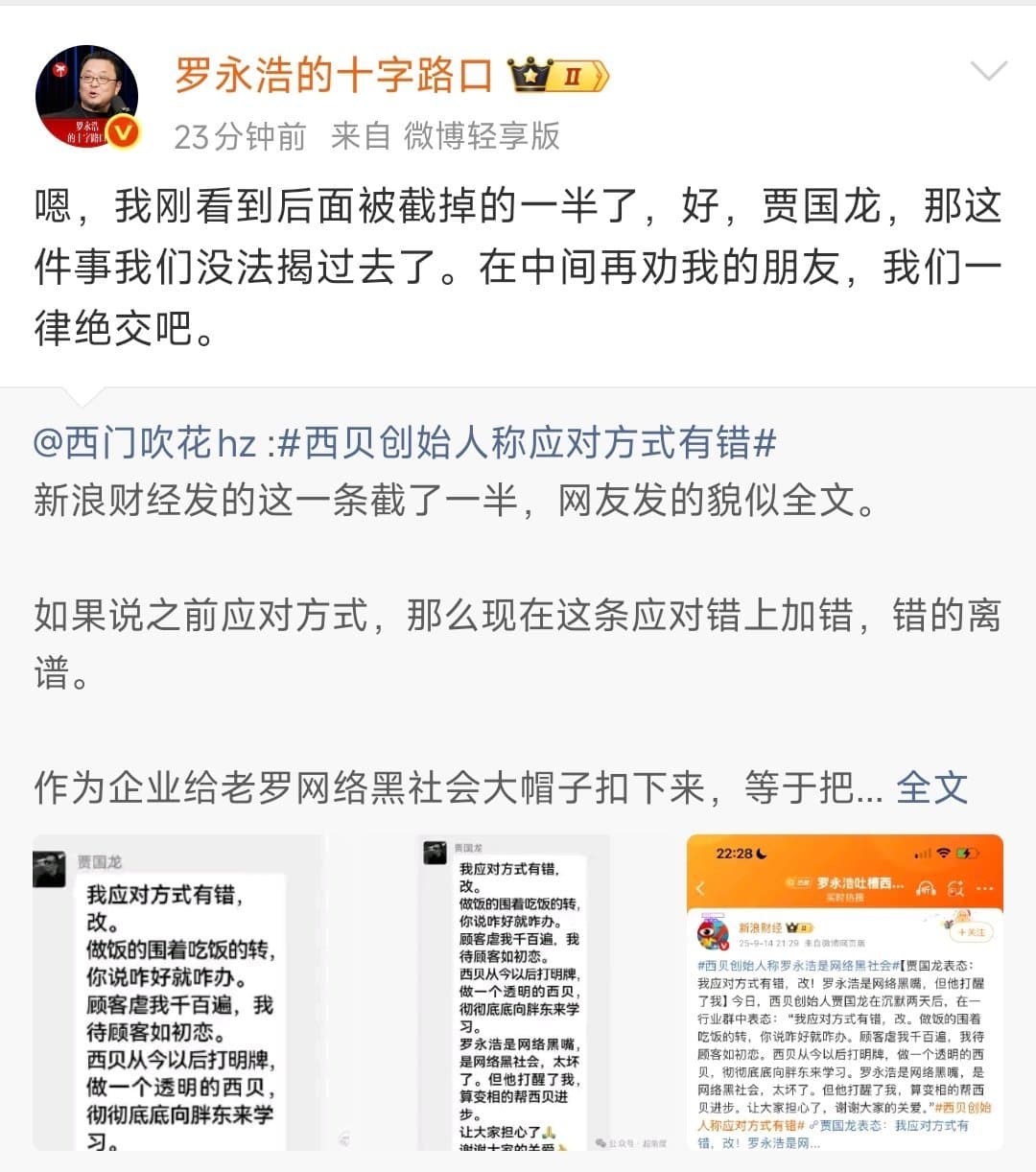

Luo Yonghao vs. Xibei: Celebrity Entrepreneur Sparks Media Storm Over Pre‑Made Dishes and Calls for Transparency

By Trending on Weibo

News & Politics

15 Sept 2025

Alipay Users Rush to Revoke Permissions Over Hidden Authorizations, Sparking Nationwide Privacy Debate

By Trending on Weibo

Tech

15 Sept 2025