Global Gold Prices Plummet to Three-Week Low Amid Easing Geopolitical Tensions

The international gold price has experienced a significant drop, plummeting to its lowest point in nearly three weeks. This downturn occurred just as the price was approaching the $3000 per ounce mark. On February 25, the gold price saw a notable decline of 1.5%. According to analyses, the primary factors contributing to the fluctuation in gold prices include the easing of geopolitical risks, particularly in regions such as Russia and Ukraine, uncertainty surrounding U.S. tariff policies, and investors' decision to take profits after reaching high positions.

3 March 2025

The easing of geopolitical tensions can lead to reduced demand for gold as a safe-haven asset, causing its price to decrease. Additionally, the uncertainty surrounding U.S. trade policies can influence investor confidence and, consequently, impact gold prices. The decision by investors to realize their profits after gold prices had risen also plays a significant role in the current downturn. The significant drop on February 25, followed by continuous declines, including a further drop of over 1% on February 27 that broke the $2900 per ounce threshold, underscores the volatility of the gold market.

The close at $2848.50 per ounce on February 28, representing a 1.64% decline, marked a notable movement in the market. The cumulative drop of over 3.5% for the week, with the main gold futures contract price falling 3.55%—the largest single-week decline since November of the previous year—highlights the substantial impact of these factors on gold price movements. As investors and market observers look to the future, the question of whether gold prices will continue to decline or rebound remains.

Market analysts are divided on the future trajectory of gold prices. Some predict that the downward trend may continue, citing the easing of geopolitical tensions in Ukraine and the Middle East, which have reduced the appeal of gold as a safe-haven asset. Historically, gold prices have experienced five significant declines, and the current market sentiment suggests that the upward momentum may be waning. However, others argue that the price of gold may rebound from its current low, as investors seek to buy on the dip. With the gold price having dropped below the $2900/oz mark, some investors may see this as an opportunity to enter the market, but caution is advised against buying at high prices, lest they get caught off guard by another significant decline.

Investors are responding with a mixed bag of strategies to the dive in gold prices, sparking a debate among market analysts and investors, with some advocating for buying into the dip, while others recommend a more cautious approach. According to some analysts, this could be an opportune moment to purchase gold, but with the caveat of avoiding entry at high prices. The emphasis is on careful investment, warning against blindly following market trends. Others suggest diversifying portfolios to hedge against potential losses, highlighting the importance of a balanced investment strategy.

The reaction from investors underscores the complexity and unpredictability of the gold market. While some see the current prices as a buying opportunity, others are adopting a wait-and-see approach, keenly watching for signs of market stabilization before making their next move. Ultimately, the decision to invest in gold at this point depends on individual financial goals and risk tolerance. The key is to have a clear investment strategy and stick to it, rather than making impulsive decisions based on short-term market swings.

The drop in gold prices may have an impact on the global economy. As a safe-haven asset, gold price fluctuations can reflect market expectations of the economy. A decline in gold prices may increase market optimism about the economy, but it may also increase market volatility. On one hand, the decline in gold prices may indicate investors' confidence in economic recovery, driving up the prices of risk assets and stimulating economic growth. On the other hand, the decline in gold prices may lead to increased market volatility, as investors shift funds from safe assets to risk assets, resulting in increased asset price fluctuations.

Furthermore, the decline in gold prices may influence monetary and trade policies in various countries. For example, if the decline in gold prices leads to a strong US dollar, it may cause other countries' currencies to depreciate, affecting international trade and investment. Additionally, the decline in gold prices may lead central banks to adjust their monetary policies, such as raising interest rates, to address the risk of economic overheating.

In conclusion, the impact of the decline in gold prices on the global economy is complex, bringing both opportunities for economic growth and risks of market volatility. Therefore, investors and policymakers need to closely monitor gold price movements and respond flexibly to potential economic and financial market changes. In the current global economic environment, the fluctuations in gold prices highlight the need for investors and policymakers to remain vigilant and responsive. As the global economy faces various uncertainties, the trend of gold prices will continue to be widely watched.

Comments

Share this article

Related Articles

Xi Jinping Elevates Cybersecurity to Core National‑Security Pillar, Driving China’s Quest for a Cyber Superpower

By Trending on Weibo

News & Politics

15 Sept 2025

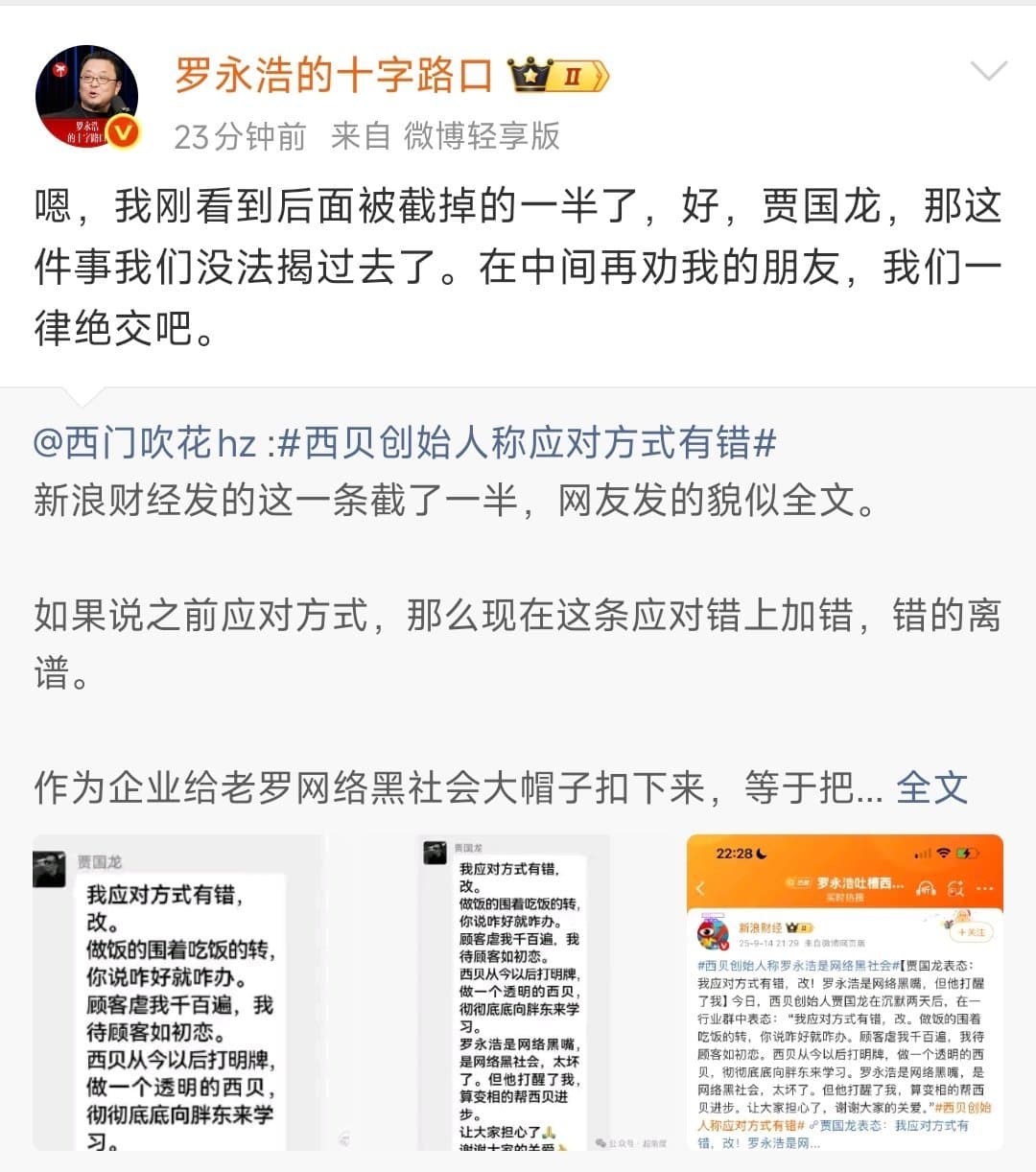

Luo Yonghao vs. Xibei: Celebrity Entrepreneur Sparks Media Storm Over Pre‑Made Dishes and Calls for Transparency

By Trending on Weibo

News & Politics

15 Sept 2025

Weibo Celebrates Autumn Harvest as China’s Fields Become the Nation’s Most Beautiful Canvas

By Trending on Weibo

News & Politics

15 Sept 2025

China Enacts First Comprehensive Rental Regulations to Legalize and Stabilize the Rental Market

By Trending on Weibo

News & Politics

15 Sept 2025

Beijing’s Weather Emerges as a Barometer for China’s Climate Policies and Public Life

By Trending on Weibo

News & Politics

13 Sept 2025