Shanghai Local Stocks Surge: Netizens Discuss Impact on Economy and Future Trends

In a recent flurry of activity on China's social media platform Weibo, users have been discussing the unexpected spike in share prices of several local Shanghai-based companies. The hashtag #上海本地股集体爆发# (Shanghai local stocks group explosion) has been trending, as netizens have been sharing their thoughts on this phenomenon.

23 January 2024

One user, 张旺961, posted a list of different sectors and the percentage increase in share prices of companies operating within those industries. F5G concept led the way with a 3.30% increase, followed by companies in the mobile gaming, online gaming, and electronic trading sectors.

Another user, A股叶艾茂, suggested that the increase in the share prices of these companies was a result of the state stepping in to protect the local economy. They pointed out that both Shanghai and Shenzhen have substantial funds to protect their local stock markets.

The topic of discussion has also extended beyond the increases in share prices to the broader impact on China's economy. One user, 小雪人, noted that the recent market activity appears unrelated to the release of mega-hit film, Feng Hua, which has been receiving rave reviews.

Meanwhile, another user, 己|二|十呈ee, pondered whether famous Chinese investors, like China's largest private equity fund manager, Li Xiang, and her wealthy associates, are behind the recent market surge.

Several users have also discussed the overall impact of the Chinese stock market on the country's economy, with one user pointing out that China's stock market is essential to the country's continuing economic growth. The user argued that stock market activity should be supported by improved market rules and fundamental reforms.

In other news, renowned Chinese investor, Xiaochun Li, has backed a proposal by China's Ministry of Finance to ease restrictions on foreign exchange transactions, which could potentially help boost the country's economy.

As the Shanghai market continues to rally, netizens have been paying close attention to the leadership of the government and major shareholders, such as Li Xiang, Chen Haipeng, and Huo Jiang, as they try to predict future trends in the market. Meanwhile, other Weibo users have been sharing images of themselves cheering on the Shanghai market, wearing Chinese flags and bandanas.

While netizens in China are closely watching the nation's stock market, the world is also paying attention to the rising share prices of Chinese companies. Commentators in the United States and Europe have noted that the recent surge in the share prices of Chinese companies may signal a change in the direction of global economic growth, with China's stock market playing an increasingly important role.

Chinese analysts have also pointed out that the rapid growth of the stock market in recent months has been partly due to the stability of the Chinese economy, which has been attracting more and more foreign investors. In addition, many Chinese companies have been leveraging the latest advancements in technology, such as artificial intelligence (AI) and virtual reality (VR), to drive innovation and boost their share prices.

Despite the enthusiasm for the Chinese stock market, there are still concerns about potential risks and challenges that could impact the market in the near future. For instance, some analysts have noted that China's economy remains heavily dependent on government support and infrastructure spending, and any changes to these policies could have a significant impact on the stock market.

In conclusion, the recent surge in the Shanghai stock market has been the subject of intense discussion among Weibo users, who are closely watching the leadership of the government and major shareholders for clues about future trends in the market. The rapid growth of the Chinese stock market has also caught the attention of global investors and commentators, who are watching closely to see how the world's second-largest economy will shape the future of global economic growth.

Share this article

Related Articles

Xi Jinping Elevates Cybersecurity to Core National‑Security Pillar, Driving China’s Quest for a Cyber Superpower

By Trending on Weibo

News & Politics

15 Sept 2025

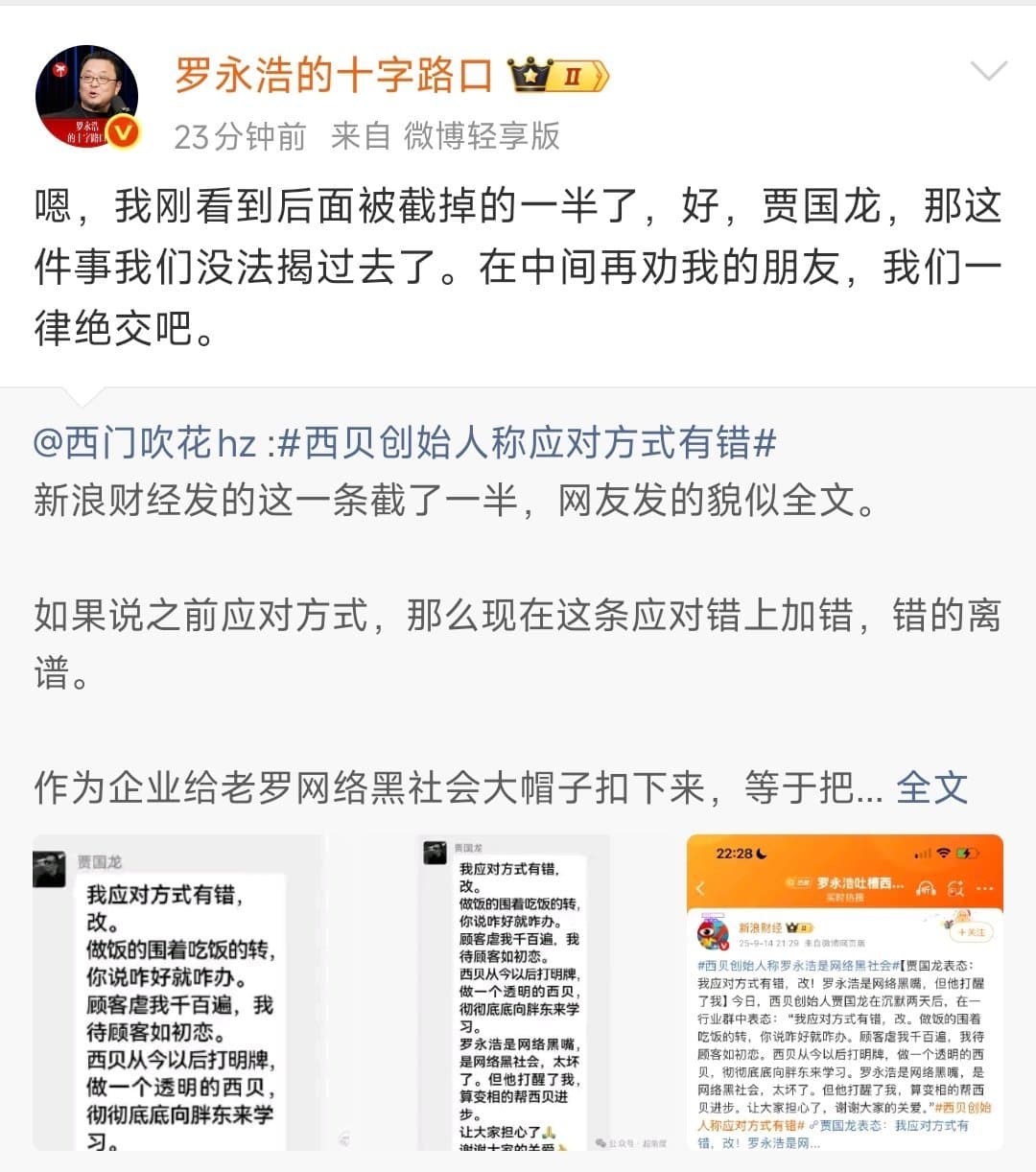

Luo Yonghao vs. Xibei: Celebrity Entrepreneur Sparks Media Storm Over Pre‑Made Dishes and Calls for Transparency

By Trending on Weibo

News & Politics

15 Sept 2025

Weibo Celebrates Autumn Harvest as China’s Fields Become the Nation’s Most Beautiful Canvas

By Trending on Weibo

News & Politics

15 Sept 2025

China Enacts First Comprehensive Rental Regulations to Legalize and Stabilize the Rental Market

By Trending on Weibo

News & Politics

15 Sept 2025

Beijing’s Weather Emerges as a Barometer for China’s Climate Policies and Public Life

By Trending on Weibo

News & Politics

13 Sept 2025